There are two major concerns people have when thinking about starting their local retail business.

First, will they be able to get financing?

Secondly, can they live on less money during the first few years of operation?

The benefits of being your own boss make business ownership very attractive, but there is risk associated with starting your own profitable small business.

Entrepreneurs are prudent to be concerned about financing their business and livelihood while their businesses are getting off the ground. It takes an average of 12 to 18 months for the average new business to break even.

Entrepreneurs are prudent to be concerned about financing their business and livelihood while their businesses are getting off the ground. It takes an average of 12 to 18 months for the average new business to break even.

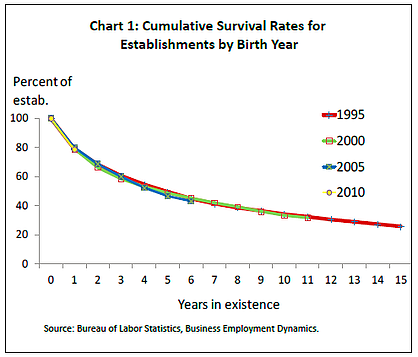

According to the SBA (Small Business Administration), about two-thirds of businesses with employees stay in business at least 2 years and about half survive at least 5 years.

With approximately one third of all new businesses failing within the first two years, owners should ask the question, “What are the differences between profitable small businesses and those who are not?” early in their due diligence process. While there are many key factors that contribute to small business success, sufficient funding and saving enough money are two factors that top the list.

It takes money to make money. It’s true! And it takes a good deal of capital to start and grow a local small business. The amount of money needed to successfully operate a business depends on the type of business and the business owner’s goals. Without adequate funding an owner may find it difficult to adapt to changes in the market place and be tempted to underestimate the cost of business expenses. The owner may find that needed resources and support are unaffordable. The potential for competitive advantage is compromised. A business may have to close its doors or even worse file for bankruptcy if it does not have enough capital to support on-going operations.

There are two types of financing that would-be business owners can use to finance a business: debt or equity. Debt financing gives you access to capital through borrowing. Equity financing increases business capital through investment of an owner’s personal assets into their business, or by giving a stake in the business or promissory note to investors in exchange for investment dollars.

Debt financing is typically used to fund smaller businesses. Debt financing is usually borrowed at rates lower than one would pay through equity financing. Debt financing can be obtained through a number of sources including:

Debt financing is typically used to fund smaller businesses. Debt financing is usually borrowed at rates lower than one would pay through equity financing. Debt financing can be obtained through a number of sources including:

– Family, friends, business associates

– Government funding

– Commercial banks

– Commercial financing companies

– Personal loans

– Personal installment loans

– Insurance loans

Equity financiers on the other hand, are usually looking for a higher return on their investment. Equity investors lend money to start-up, highly innovative, companies or similar type companies that are more established and seek more capital to bring their product to market or increase market share. Investment in equity financing is riskier than other investments; therefore the corresponding return on those investments tends to be higher.

Most small businesses use their own cash or debt financing to fund their new ventures.

Regardless of source, there are pros and cons to obtaining financing. For example, family, friends and business associates might lend money at interest rates lower than market rates and be more interested in your business than a banker would be. They may also require an ownership interest in your business or feel that they have the right to offer advice on the operations of the business.

The economic downturn has made it more difficult for people to obtain loans through local or commercial banks. Borrowers need to have more personal assets, invest more of their own money, and face more stringent criteria than in the past in order to secure a loan.

Government funding through an SBA (Small Business Administration) loan is another option for those contemplating small business ownership. Those that meet the SBA’s definition of a small business are eligible for SBA funding. The SBA typically guarantees up to 90% of the loan that an owner receives through local lenders, instead of directly funding loans. SBA funding increases the chances that entrepreneurs, who are unable to receive funding on their own, will receive a loan through a local bank. It’s a good idea for owners to meet with several SBA lending partners. Guidelines are strict, so you’ll want to prepare a detailed business plan that will inform and excite your lender about your venture.

When taking on the task of financing your own business, choose the source of debt type that is right for you. Remember there are trade-offs associated with borrowing money. Money that is used to service debt and pay interest isn’t available to grow the company. Review your business plan and goals and make sure you secure enough capital to finance your business to success. Have enough funds to operate the business, funds saved to pay for any unforeseen expenses and funds for you to comfortably live before your business becomes profitable. This approach will increase your chances of being successful as a small business owner.

When taking on the task of financing your own business, choose the source of debt type that is right for you. Remember there are trade-offs associated with borrowing money. Money that is used to service debt and pay interest isn’t available to grow the company. Review your business plan and goals and make sure you secure enough capital to finance your business to success. Have enough funds to operate the business, funds saved to pay for any unforeseen expenses and funds for you to comfortably live before your business becomes profitable. This approach will increase your chances of being successful as a small business owner.

Looking for the right small business for you? Learn more about opening a whole wheat bakery:

Resources:

1 http://allbusinessloans.com/top-reasons-for-small-business-success-and-failure/

2 Bureau of Labor Statistics, Business Employment Dynamics

3 http://www.go4funding.com/articles/small-business/the-abcs-of-small-business-funding.aspx

Photo credits:

Money with Dice photos8.org

“Piggybank Leaving Bank Showing International Currencies” by Stuart Miles Freedigitalphotos.net

“Success and Hand” Stock Photo Freedigitalphotos.net